nys workers comp taxes

We use cookies to give you the best possible experience on our website. NY Rates are currently about 155 higher than the national median.

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Or you can complete the Tip Sheet.

. You may also contact the Task Force weekdays at 518 485-2144 between 8 am and 4 pm or send us an e-mail. Do you claim workers comp on taxes the answer is no. Home Tax Resources Recent Articles What NY Employers Need to Know About Workers Comp and Disability.

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. Amounts you receive as. - Answered by a verified Tax Professional.

Ad Looking to file your state tax return. You are responsible to pay. The quick answer is that generally workers compensation benefits are not taxable.

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of. Copy A along with Form W-3 goes to the Social Security Administration. Learn more about the workers comp environment and how to minimize costs.

Also under IRS regulations non-taxable workers. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. No Tax Knowledge Needed. Answer Simple Questions About Your Life And We Do The Rest.

Explore state tax forms and filing options with TaxAct. The franchise tax based on premiums also is referred to as premium tax. Answer Simple Questions About Your Life And We Do The Rest.

Is workers comp taxable in NYS for either State or Federal. You may need to report this information on your 2021. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in. Ad Get injured workers back to health and work as quickly as possible with workers comp. Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income.

New York is a Loss Cost state which. Ad Get injured workers back to health and work as quickly as possible with workers comp. Centralized mailing address for all workers compensation claims and claim-related documents.

Workers Comp Exemptions in New York. However Workers Compensation 1084 exempts the surcharge that insurers charge their insureds as. File With Confidence Today.

The workers compensation system in NY is administered by NYCIRB. If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45. File With Confidence Today.

TaxAct can help file your state return with ease. Workers compensation benefits are not considered taxable income at the federal state and local levels. Learn more about the workers comp environment and how to minimize costs.

Overview When the Workers. The IRS in Publication 907 specifically states that workers. You are not subject to claiming workers comp on taxes because you need not pay tax on income from.

Your maximum refund guaranteed. NYS Workers Compensation Board Centralized Mailing Address PO Box 5205 Binghamton NY. As a small business owner you may think that youre exempt from.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. No Tax Knowledge Needed. If you received an income tax refund from us for tax year 2020 view and print New York States Form 1099-G on our website.

According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. Workers comp benefits are non-taxable insurance settlements.

Is Workers Comp Taxable Workers Comp Taxes

New York State Workers Compensation Schedule Loss Of Use Chart Items Tagged New York State 52 Chart Example Of News New York State

What Wages Are Subject To Workers Comp Hourly Inc

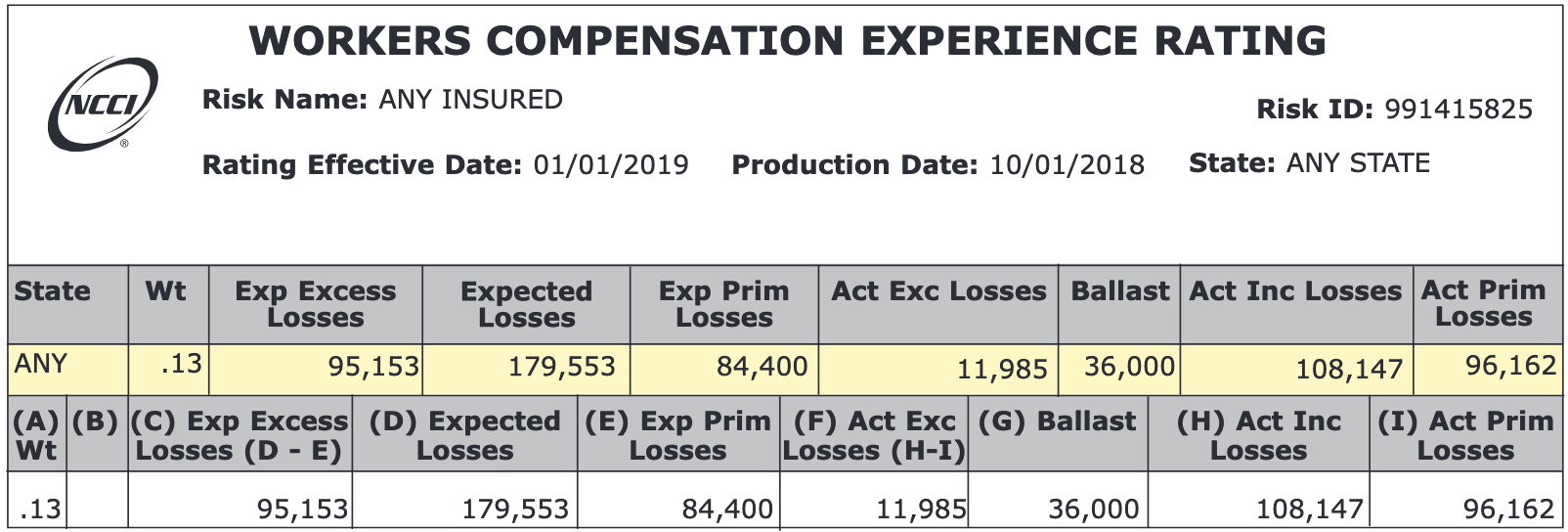

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

California Businesses May Have To Pay More For Workers Compensation As Benchmark Rates Are Under Review

Workers Compensation Insurance Overview Amtrust Financial

The Georgia Workers Compensation Panel Of Physicians Are You Following The Rules Marathonhr Llc

What Employers Need To Know About Fmla Workers Comp Insure My Work Comp

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Ashworth A02 Lesson 1 Exam Attempt 1 Answers Workers Compensation Insurance Payroll Taxes Exam

Luis Rojas Named New Manager Of The New York Mets Small Business Insurance Commercial Insurance Business Insurance

When Does Workers Comp Start Paying After A Workplace Injury

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Workers Comp Is Never Off The Clock

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

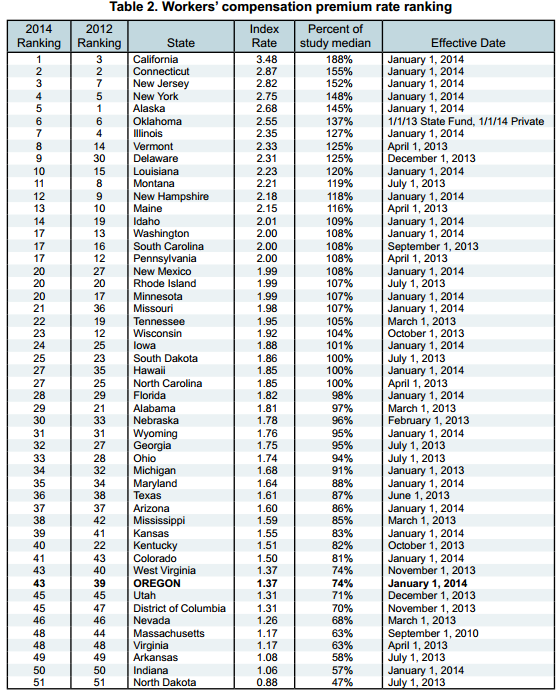

How States Rank High To Low In Workers Compensation Premiums

Average Workers Comp Settlement Amounts How Much Is My Case Worth