estate tax changes build back better

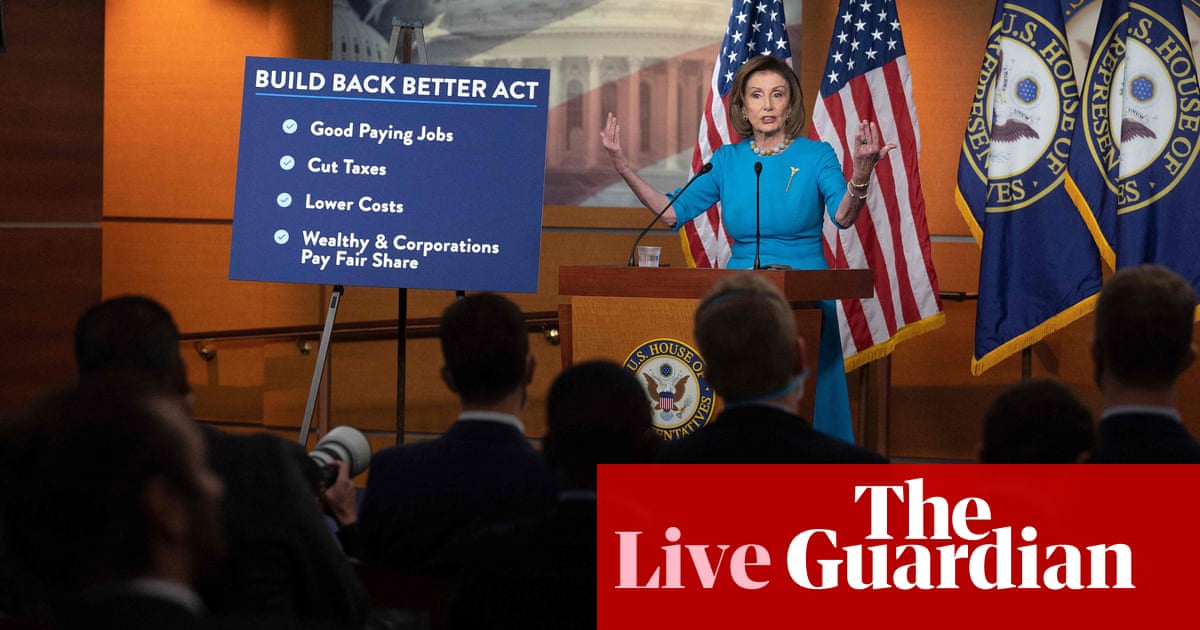

Build Back Better Act and Estate Planning Changes. The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate.

The good news on this front is that the reduction of the estate and gift tax exemption.

. 2022 Updates to Estate and Gift Taxes. Our tax expert weighs in. Proposed Federal Tax Law Changes Affecting Estate Planning.

The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust which would have virtually eliminated the use of grantor trusts as an estate planning tool. The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build. Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross income of a trust or estate.

House Rules Committee releases updated version of the Build Back Better Act initial impressions Substantial number of changes to the tax-related provisions of the bill. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions.

Day Pitney Generations Newsletter. The BBBA proposal seeks to reduce these. The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

President Bidens Build Back Better Act BBBA has made a significant first step towards passage as the House Ways and. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in. November 5 2021.

3 version introduced an increase to the cap with a slightly higher. Gift and Estate Taxes Proposed Under the Build Back Better Act. The BBBA proposal seeks to reduce these.

These proposals are currently under. First the current USD117-million estate and gift tax exclusion was provided under a temporary clause of the Tax Cut and Jobs Act of 2017 and will be halved on 1 January 2026. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022.

The House Ways and Means. Lowering the gift and estate tax exemptions seems a lock. 5376 the Build Back Better Act.

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law.

Tax provisions in the Build Back Better act Extending expanded earned income tax credit. 5376 that falls under his committees jurisdiction. On December 11 Senate Finance Committee Chair Ron Wyden released an update to the section of the Build Back Better Act HR.

Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. Build Back Better Act and What the Changes to Gift and Estate Taxes Could Mean for Your Family Business. On September 13 2021 the House Ways and Means Committee released a.

SIGNIFICANT ESTATE GIFT AND INCOME TAX CHANGES PROPOSED UNDER THE BUILD BACK BETTER ACT. The bill would extend the changes to the earned income tax credit that were.

The Great Reset Conspiracy Flourishes Amid Continued Pandemic Anti Defamation League

2020 Was The Right Time To Increase My Real Estate Portfolio By 1 Million Wealth Building Estate Tax Being A Landlord

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us Politics The Guardian

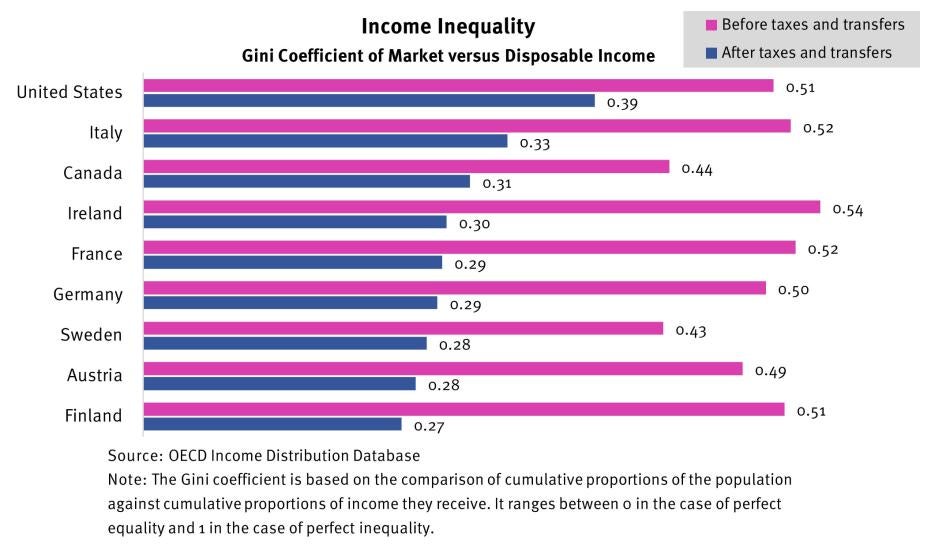

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Biden Announces 2 Trillion Climate Plan The New York Times

How To Manage Your Money As A Couple In 9 Steps Managing Your Money Couples Money Management Couples Money

Facebook Likes That Are Real Real Estate Infographic Real Estate Advice Real Estate Tips

Would A Beefed Up Irs Bring In More Tax Revenue As Biden Says Experts Are Divided Marketwatch

Refinancing How Homeowners Can Save Money Or Cash Out Their Equity Homeowner Cash Out Being A Landlord

Biden S Build Back Better Plan Explained What It Is And What S In It Cnn Politics

Manchin Says Build Back Better Is Dead Here S What He Might Resurrect

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

How To Avoid A Big Tax Penalty On Your Retirement Savings Cnbc Saving For Retirement Retirement Finances Money

/media/img/posts/2022/02/BBB_figure_5/original.png)

Biden S Biggest Idea On Climate Change Is Remarkably Cheap The Atlantic

Ag Policy Blog There S No Cow Tax In The Build Back Better Bill

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act