unified estate tax credit 2020

15000 per person per person. The tax reform law doubled the BEA for tax-years 2018 through 2025.

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

This was less than 01 of the estimated 27 million people expected to die that year.

. The tax applies to property that is transferred by will or if the person has no will according to state laws of intestacyOther transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. You can also avoid the estate tax by gifting small amounts each year to your heirs. The percentage is so low because the federal government offers a generous estate tax exemption.

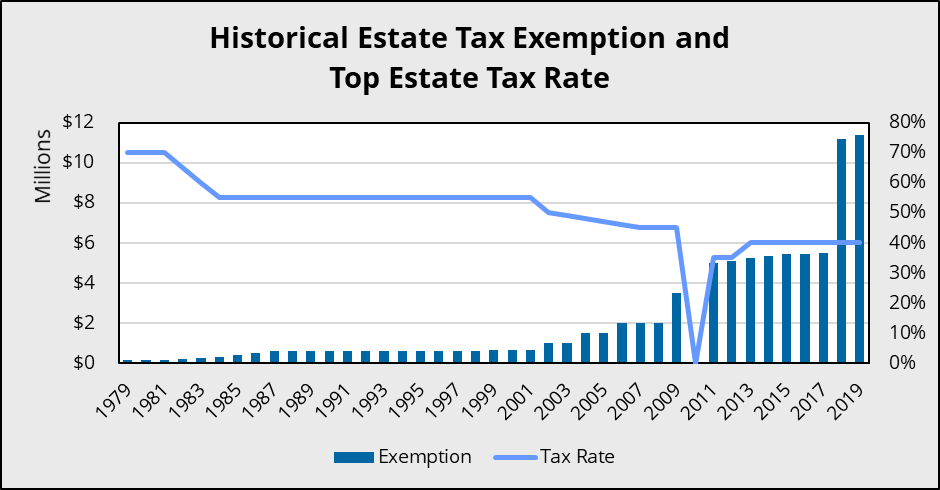

Lifetime Exemptions and Tax Rates 2000-2022. Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. Gifts made on or after January 1 2005 are subject tot he Connecticut Unified Gift and Estate Tax.

The unified credit is simply the tax liability that would result if the the amount of the exclusion werent excluded. How Might the Biden Administration Affect the Unified Tax Credit. Inheritance tax treaties often cover estate and gift taxes.

This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples. The exclusion amount in 2021 increased to 11700000. How did the tax reform law change gift and estate taxes.

The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies. The credit is first applied against the gift tax as taxable gifts are made. The Gift Tax Annual Exclusion remained the same between 2019 and 2020.

In general all transfers of real or personal property by gift whether tangible such as a car boat or jewelry or intangible such as cash that are made by you the donor to someone else the donee are subject to tax if the fair market value of the property. Basically if there was no such thing as an exclusion a gift of 534M example of 2015 exclusion amount would create a tax liability of 2117800. Columbia Universitys Center on Poverty and Social Policy.

Generally fiscal domicile under such treaties is defined by reference to domicile as opposed to tax residence. Only 1900 of an estimated 4100 estates were expected to be taxable in 2020 according to the Tax Policy Center. Such treaties specify what persons and property are subject to tax by each country upon transfer of the property by inheritance or gift.

Therefore for 2017 the unified tax credit is 2117800. Annual Exclusion for Gifts. The gift tax and the estate tax share the same exemption often referred to as the unified tax credit The amount is adjusted to keep pace with inflation often on a yearly basis.

The 117 million exception in 2021 is set to expire in 2025. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. 2 days agoFILE - A swing sits empty on a playground outside in Providence RI March 7 2020.

To the extent that any credit remains at death it is applied against the estate tax. The tax is then reduced by the available unified credit.

Tax Guidelines About Gifting Turbotax Tax Tips Videos

![]()

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Texas Estate Tax Planning Frisco Estate Tax Attorney Haiman Hogue

What Is The Alternate Valuation Date For Federal Estate Tax High Swartz

It S Not About The Tax It S About Liquidity

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

5 Ways The Rich Can Avoid The Estate Tax Smartasset

Estate Tax Planning Legacy Counsellors P C

Nonresident Individual Income And Transfer Taxation In The United States

![]()

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Time To Change Your Estate Plan Again

Factor 2020 Cost Of Living Adjustments Into Your Year End Tax Planning

Sec 2010 Unified Credit Against Estate Tax

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Factor 2020 Cost Of Living Adjustments Into Your Year End Tax Planning